If you sell your property within the stated period, you will have to pay income tax on any profit made on the property. What is considered profit is based on a few factors. There are exemptions to this rule (for instance, if you live in it as your main home, or if you have inherited the property).

There are four main changes to the rules:

- The bright-line test period now runs from when you enter into an agreement to purchase a property until the date that you enter into an agreement to sell it (it used to run from settlement to the date of the agreement to sell).

- The time period for the test is now 10 years, rather than 5 years.

- There are changes to the main home exemption (this was where if it was not your main home for 100% of the time you owned it, then you could be taxed on the portion of time it was not your main home).

- The new time period of 10 years does not apply to new builds.

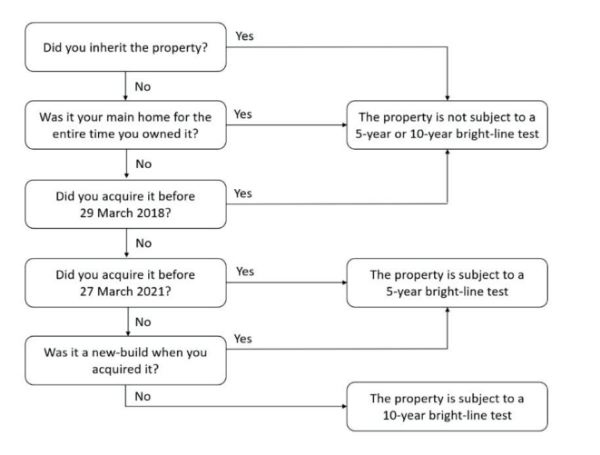

The IRD has made a flowchart to help determine if selling your property would be subject to the bright-line test.

Ref: (https://www.interest.co.nz/sites/default/files/embedded_images/IR%20FACTSHEET%20Brightline%20test_0.pdf)

With the extension of the bright-line rules coming into effect so quickly, questions have been raised about Sale and Purchase Agreements that have already been entered into. For many agreements dated before 27 March 2021, the bright-line period that will apply is five years.

Sale and Purchase Agreements that are not new build agreements, and are dated after 27 March 2021, have the 10 year bright line apply.

Over time you may have moved out of your home and rented out the property. If the property has not been your main home for more than 12 months before you enter into an agreement to sell it, the main home exclusion will not apply. Tax will be paid on the profit but this profit will be apportioned based on the time it was not your main home.

The IRD has a helpful property tool to assist you to determine if tax implication will arise from the sale. However, if you have purchased a property in the last 4-5 years and are thinking about selling you should seek accounting advice before entering into an agreement to sell.

If the information in this article has raised some questions for you or you would like some advice before selling your property, please call one of Gibson Sheat’s property experts today.

Call Gibson Sheat

Email Gibson Sheat